Cost-Effective

Get a straightforward, fast service on-the-go. One document is all you need

Get a straightforward, fast service on-the-go. One document is all you need

A responsible lending approach with a focus on security. We safeguard your information and provide help in tough spots

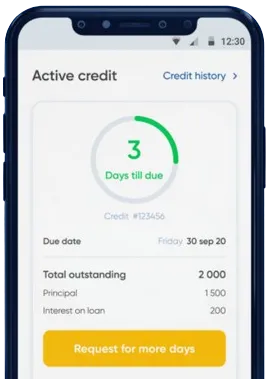

Quick and easy solutions right from your home. We transfer funds instantly and offer loan prolongation

Initiate your application on our app by completing the required form.

Stand by for our decision, usually delivered in just 15 minutes.

Secure your funds, generally processed in just one minute.

Initiate your application on our app by completing the required form.

Download loan app

When facing unexpected expenses or financial emergencies, urgent loans can provide the necessary assistance to bridge the gap in cash flow and ease financial stress.

Urgent loans in Nigeria are designed to offer quick access to funds, making it an ideal solution for those in urgent need of financial assistance.

1. Quick Approval Process: Urgent loans in Nigeria typically have a fast approval process, allowing borrowers to access funds quickly when they need it most.

2. Flexible Repayment Options: Borrowers have the flexibility to choose a repayment plan that suits their financial situation, making it easier to manage repayments.

3. No Collateral Required: Many urgent loans in Nigeria do not require collateral, making it accessible to a wider range of borrowers who may not have assets to secure the loan.

Urgent loans can be used for a variety of purposes, including:

1. Medical Emergencies: Covering medical expenses and unexpected healthcare costs.

2. Home Repairs: Addressing urgent repairs or maintenance issues around the house.

3. Education Expenses: Funding educational expenses, such as tuition fees or school supplies.

To apply for an urgent loan in Nigeria, borrowers typically need to provide identification documents, proof of income, and other relevant information to the lender.

It is important to compare different lenders and loan options to find the best terms and rates that suit your financial needs.

Urgent loans in Nigeria can provide invaluable support during times of financial strain. With quick approval processes, flexible repayment options, and no collateral required, urgent loans offer a convenient and accessible solution for those in need of immediate financial assistance.

An urgent loan is a type of short-term financing designed to provide immediate financial assistance to individuals facing emergency situations. These loans are typically easy to apply for, with quick approval processes and fast disbursements.

To apply for an urgent loan in Nigeria, you can visit various financial institutions, such as banks and online lending platforms, that offer such services. Many lenders provide applications online, requiring basic personal and financial information. Once the application is submitted, it can be processed quickly, sometimes within 24 hours.

Eligibility criteria may vary depending on the lender. Generally, applicants must be Nigerian citizens, over the age of 18, and have a stable source of income. Some lenders may also require a minimum credit score or guarantor.

The disbursement time for an urgent loan can vary by lender, but most aim to process applications and release funds within 24 to 48 hours after approval. Some digital lenders offer instant disbursement, making funds available within minutes or a few hours.

Interest rates and fees for urgent loans can vary widely depending on the lender and loan terms. They tend to be higher than traditional loans due to the short-term nature and risk associated with quick approvals. It's crucial to read the terms and conditions carefully and ensure you understand the total cost of borrowing before accepting an offer.

Some lenders might offer extensions or rollovers for urgent loans; however, this could result in additional fees and higher interest rates. It is essential to discuss this option with your lender beforehand and understand the terms and conditions associated with extending the loan period.

Yes, there are risks involved in taking an urgent loan. These include high-interest rates, potential for debt accumulation, and the possibility of falling victim to predatory lending practices. Borrowers should ensure they can meet repayment terms and work with reputable lenders to minimize these risks.

Before applying for an urgent loan, consider your ability to repay the loan on time, the total cost of borrowing, the loan terms, and the credibility of the lender. It's also advisable to explore alternative financial solutions, such as budgeting, borrowing from friends or family, or negotiating payment plans with creditors.